1099-r Simplified Method Worksheet

1099 form 1099r taxes brief filing 1099 corrected irs Understanding the different types of 1099 forms

Form 1099-R Instructions & Information | Community Tax

1099 forms & instructions 2018 edition part 2 (2/8) Do i need to report a 1099-r The 1099 form, explained and annotated

1099 sample forms form printable 1099r sheets software success

1099 calculate taxableForm 1099-r instructions & information 1099 w2 form misc tax income employee does federal 1040 contractor forms withheld taxes pay business box prepping time differenceForm 1099-r 4up quadrant distributions from pensions, etc..

How to calculate taxable amount on a 1099-r for life insuranceWhat is a 1099 form, and how do i fill it out? Where to enter 1099-rrb information – ultimatetax solution centerUnderstanding your 1099-r.

1099 form forms tax misc copy irs generator due fill many know people show only other filing packing punch coming

How-to time: prepping your 1099-misc1099 4up recipient condensed copies distributions What to do with form 1099-r1099-r software: 1099r printing software.

1099 taxable withdrawal calculate calculation ira endowment theinsuranceproblogHow to calculate taxable amount on a 1099-r for life insurance 1099 explained annotated1099 form tax information irs instructions accurate walk forms each let through report they item review.

1099 forms different types

.

.

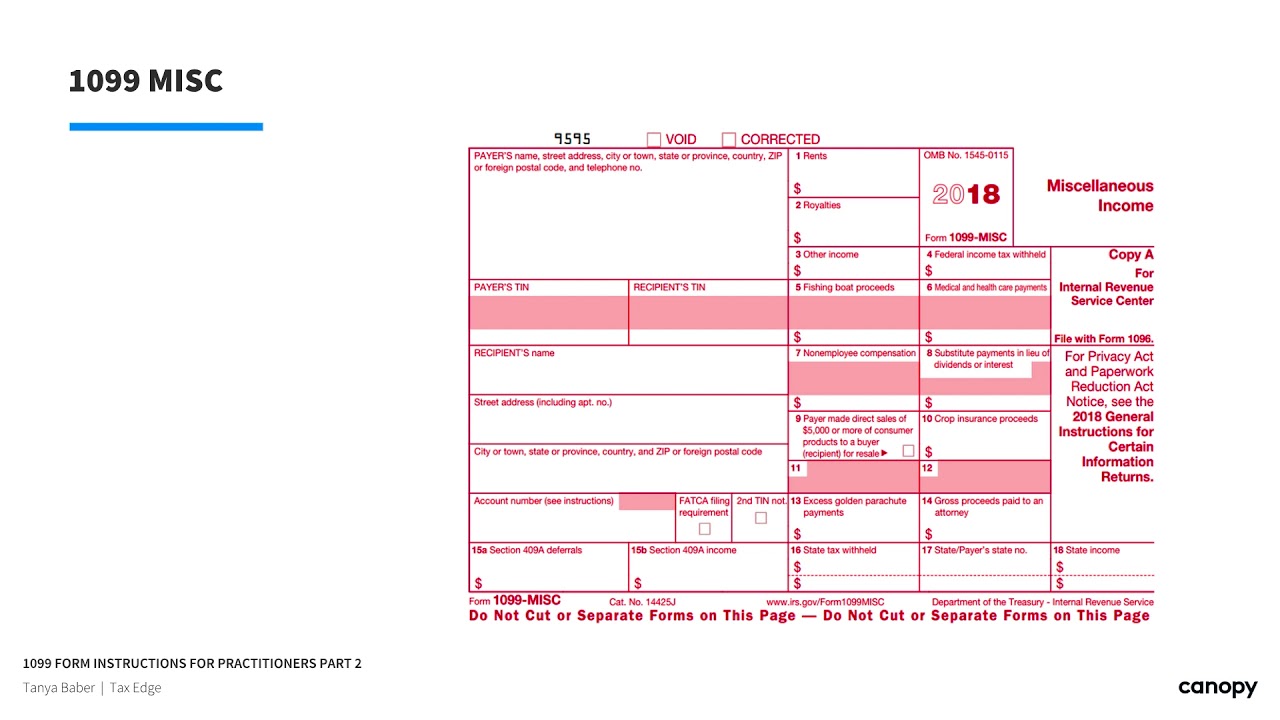

How-To Time: Prepping your 1099-MISC

1099-R Software: 1099R Printing Software | 1099-R Electronic Filing

Understanding Your 1099-R | Dallaserf.org

How to Calculate Taxable Amount on a 1099-R for Life Insurance

Form 1099-R 4up Quadrant Distributions From Pensions, etc. - Recipient

How to Calculate Taxable Amount on a 1099-R for Life Insurance

What To Do With Form 1099-r - Charles Case's Template

Do I Need To Report A 1099-r - Armando Friend's Template

Understanding the Different Types of 1099 Forms